Investment Opportunities in Developing Countries

As the global economy continues to evolve, developing countries are emerging as attractive destinations for investment. With growing populations, expanding middle classes, untapped natural resources, and rapidly improving infrastructure, these nations offer unique opportunities that can lead to high returns. While risks certainly exist, the long-term prospects often outweigh short-term uncertainties, especially for investors with a strategic mindset.

In this article, we’ll explore why developing countries are fertile ground for investment, the sectors with the highest potential, and the key factors to consider before entering these markets.

Why Invest in Developing Countries?

1. High Growth Potential

Developing economies often experience faster GDP growth than their developed counterparts. Countries like India, Indonesia, Nigeria, and Vietnam have posted consistent economic growth above the global average. This growth is driven by factors such as urbanization, improved access to education, and rising consumer demand.

2. Emerging Middle Class

A rising middle class means increased purchasing power and a shift in consumer behavior. From smartphones to housing to healthcare, the demand for quality goods and services is growing rapidly. Investors who can meet these needs stand to gain significantly.

3. Abundant Natural Resources

Many developing nations are rich in natural resources like oil, gas, minerals, and agricultural products. Investing in industries that harness these resources—whether directly or through infrastructure—can be very lucrative.

4. Infrastructure Development

With the help of foreign aid and public-private partnerships, many developing countries are investing heavily in roads, ports, energy systems, and digital infrastructure. These projects not only improve the quality of life but also open the door to investment in construction, transport, and logistics.

Promising Sectors for Investment

1. Agriculture and Agri-Tech

Agriculture remains the backbone of many developing economies. However, outdated techniques and lack of access to capital often limit productivity. This creates opportunities for investment in modern farming equipment, supply chain improvements, food processing, and agri-tech startups offering digital solutions for farmers.

2. Renewable Energy

With a growing global push for sustainability, renewable energy projects—solar, wind, and hydro—are gaining momentum. Many developing countries receive ample sunlight or have strong river systems, making them ideal for solar and hydroelectric investments. Plus, governments often offer incentives for clean energy projects.

3. Real Estate and Construction

Rapid urbanization drives demand for affordable housing, commercial spaces, and public infrastructure. Investors in real estate and construction can benefit from this demand—especially when partnering with local governments or developers.

4. Technology and Digital Services

Mobile banking, e-commerce, and fintech are booming in regions with limited traditional infrastructure. Africa’s mobile payment systems, for instance, have become world-renowned. Startups and tech ventures that solve local problems using simple but effective technology are attracting strong investor interest.

5. Healthcare and Pharmaceuticals

Many developing countries face challenges in delivering quality healthcare. This opens investment opportunities in clinics, telemedicine platforms, affordable pharmaceuticals, and medical equipment distribution.

6. Education and E-Learning

With a young population eager to learn, there’s a growing market for quality education—both offline and online. E-learning platforms, vocational training centers, and international education partnerships are all sectors with strong growth potential.

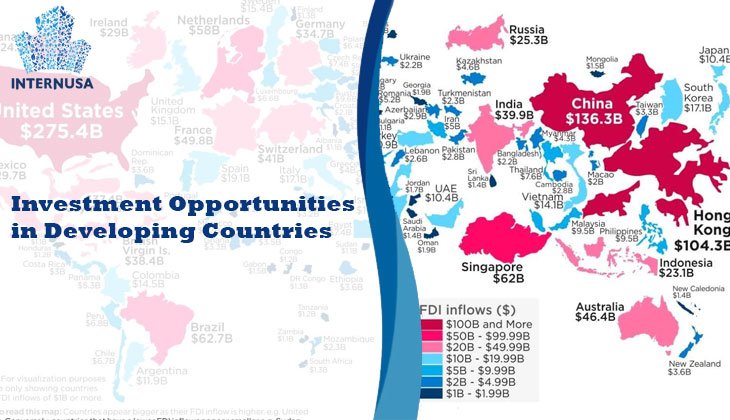

Top Regions to Watch

-

Southeast Asia – Countries like Vietnam, the Philippines, and Indonesia have strong economic fundamentals and are increasingly open to foreign investment.

-

Sub-Saharan Africa – Nigeria, Kenya, and Rwanda are leading examples of innovation and infrastructure growth.

-

Latin America – With natural resources and a growing tech scene, countries like Colombia, Peru, and Mexico are becoming more investor-friendly.

-

South Asia – India, Bangladesh, and Sri Lanka are rapidly industrializing and investing in digital transformation.

Risks to Consider

Of course, no investment comes without risks, and this is especially true in developing economies. Here are some key challenges to be aware of:

-

Political and Regulatory Instability – Shifting policies or government leadership can affect investment regulations or currency controls.

-

Corruption and Governance Issues – Lack of transparency in some countries may create barriers to entry or pose ethical concerns.

-

Currency Volatility – Exchange rate fluctuations can affect profit margins, especially if local currencies are weak or unstable.

-

Infrastructure Gaps – Inadequate transport, power, or internet infrastructure can hinder operations and logistics.

-

Cultural and Language Barriers – Understanding local customs, languages, and business practices is crucial for successful market entry.

To mitigate these risks, many investors partner with local firms, conduct thorough due diligence, and seek legal or financial advice before proceeding.

Strategic Approaches for Success

-

Start Small and Scale

Pilot programs or small-scale investments allow you to test the market before committing significant capital. -

Local Partnerships

Collaborating with local entrepreneurs or companies helps you navigate regulations, build trust, and access networks more efficiently. -

Focus on Sustainability

Environmentally and socially responsible investments not only build goodwill but also align with global development goals and attract funding. -

Utilize Development Finance Institutions (DFIs)

Institutions like the IFC (International Finance Corporation) and regional development banks can provide financing and support for private investments in developing markets. -

Long-Term Perspective

Unlike developed markets, returns in developing countries may take time to materialize. A long-term view can help smooth out short-term volatility.

Investing in developing countries offers an exciting blend of risk and reward. These markets are not only vital to global economic growth, but they also represent a chance to make a meaningful impact—economically, socially, and environmentally.

From agriculture to tech, renewable energy to education, the potential is enormous for those willing to take a calculated risk. With careful research, local engagement, and strategic planning, developing countries can offer a pathway to both profit and purpose.